This article is dedicated to my father. He had begun lecturing to me about the importance of saving when I was still in primary school. I ignored him for years. Thankfully, like any good parent, he never gave up on me. A year or so into my first job I finally understood what he was trying to tell me. My target audience for this article are graduates in their first job in the UK. However, anyone with an interest in money (I hope that’s everyone!) might find something useful in here.

The UK has a bad savings culture. Particularly with us millennials, even when we do save, we prioritise short-term expenditures over long-term ones (Financial Times). In other words, we are more likely to save for a holiday than save for the sake of saving. From my own experience of living in the UK, I have noticed that there is a lot of emphasis placed on making the most of your time. The You Only Live Once [YOLO] culture can be very demanding. Keeping oneself busy, going travelling or experiencing something new every evening, weekend and holiday are seen as signs that one is living life to the fullest. However, it is not sustainable. There are other things to do in life besides travelling or spending money on new experiences. It is also absolutely fine to spend your weekends or even a holiday at home. Relax!

Debt

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery. ― Charles Dickens, David Copperfield

The UK also has a bad debt culture. With low-interest rates maintained over the recent years, the allure of 0% interest credit cards and overdrafts has been hard to resist. It does not help that, at least in the UK, you need to have a history of borrowing to build up a good credit score!

Do not live beyond your means. You should always try to avoid being in debt. It is okay to borrow money if you intend to invest it into something that will make you more productive. An education, a house, a new business perhaps. However, it is not okay to indulge yourselves with borrowed money. It makes no financial sense to go on a holiday or buy a new television with credit. If you do so, you are burdening your future self with a liability.

If you are already in debt, your priority must be to pay off your debts first before trying to make savings. This is because debts usually cost more than savings earn. Prioritising which debts to pay off requires some thinking. MoneySavingExpert provides good advice on this matter. If you have a UK student loan to pay off, it gets a little more complicated. Have a look at this MoneySavingExpert guide on paying off UK student loans.

Why save?

- For a rainy day

- Buy a house

- Start a family

- Prepare for a comfy retirement

- Make investments

- Improve your creditworthiness

You owe it to your future self to save your money now.

You never know when life is going to throw you a curveball. You need to have cash on hand, or liquid assets, to tackle unexpected expenditures. I recommend having at least three months salary stored in an easily accessible asset such as a current account or an easy-access savings account. Savings can give you a sense of financial stability. Not being overly dependant on your monthly paycheck or the ability to absorb some financial shocks can, at least in my opinion, allow you to sleep better at night.

A house is one of the primary assets that are worth saving for. It is an asset that can generally be expected to appreciate in value in the long term because the growth in demand for it almost always outpaces supply. You may also want to buy a house if you intend to start a family or settle down somewhere.

You also need to think about your retirement. Depending on which country you are a citizen of, you may have access to a state pension. In the UK, the maximum state pension you can expect to receive is approximately £160 per week or £650 a month at the moment (New State Pension). Is that enough? Further below, I make some estimates of living costs and the state pension does not cut it. Even the living wage, calculated based on the cost of living in the UK, is currently set at about £8.75 an hour (Living Wage Foundation) and it’s safe to conclude that you should not expect to live comfortably off a state pension. The state pension age is also a whopping 65 for men (slightly lower for women), and it is always under review as life expectancy increases (Age UK). I would also advise against putting your life in the hands of politicians. They do not have a good track record of having the common man’s best interest at heart.

A personal or workplace pension is a worthwhile investment. Essentially you put away a fraction of your monthly income into a pension pot, which you can only access once you have retired. The main attractions of investing in a pension are that you get tax relief on the amount that you put away, and your employer also chips in. The following video explains how pensions work.

Once you start saving, you will naturally want to do something with those savings. Savings accounts are just one of the many places that you can tuck away your money. MoneySavingExpert is an excellent resource for finding the best interest-paying bank accounts. At the time of writing this article, the Bank of England interest rate is at a measly 0.50%. As a result, interest rates for most savings accounts are meagre. The inflation rate at the time of writing this article is 3.1% according to the Bank of England. Therefore, unless your savings are earning at least 3.1% interest, the purchasing power of your savings is reducing with time!

There are some other assets that you can invest in. Before you invest in an asset, you must make sure to educate yourself on what the asset is and the associated risks. For first-timers interested in getting into the stock market, I would recommend opening a Stocks & Shares ISA and a Trading account with interactive investor. It has a very beginner friendly User Interface. What I particularly like about it is that it allows you to hold and make investments in foreign currencies such as the US Dollar. I also use Charles Stanley Direct and have been quite happy with them for investing in the UK. Investopedia has lots of beginner-friendly tutorials on investing, such as Investing 101 if you want to find out more. I will not say much more about investing in this post.

The assets you own dictate your borrowing power. I cannot overstate the importance of being able to get credit. Credit allows you to make new investments, such as starting a new business or buying a house, that you do not have ready cash for. It can help accelerate the growth of your portfolio if things go well. The following video provides an excellent explanation of what credit is.

The above reasons are all good reasons to get into money management. However, there is one other reason that appeals to me more than any other. Money management is fun! To me, it is just as enjoyable as playing a game. There is so much to learn about the world of money. The more I learn, the more ignorant I feel! Managing money is hard, and I enjoy the challenge. Investing is risky, and I love the thrill of taking a calculated risk. I enjoy making progress, but I also like learning from my mistakes and failures. It is so much easier to manage your money if you enjoy the process. So, my advice to you would be to try and find the joy in money management.

The importance of metrics, tracking and goals

Before you get started on your savings journey, you need to ensure that a few necessary things are in place:

- A budget

- A way of tracking your expenditures and net worth

- A savings goal

Having a budget ensures that you do not spend money that you do not have. Tracking your expenditures and comparing them to your budget allows you to make decisions to change the budget or your spending habits to bring them more into line with each other. Your net worth is a Key Performance Indicator [KPI] that shows you how your financial situation is changing. An increasing net worth is a tangible reward for your efforts and therefore is a very crucial metric. A savings goal gives you something to aim for and motivates you to optimise your life to help you achieve your goal.

Moneyhub is my favourite app for tracking my finances. Before Moneyhub I had tried using an MS Excel spreadsheet, other tracking apps such as OnTrees and Money Dashboard, writing a Python script… I found that Moneyhub has the best customer service and User Interface. It was the most reliable of all the apps that I compared. Most importantly, it cost me very little of my own time. As an aside, time management is closely related to money management. However, time management is an even more complicated topic, and I’ll reserve my thoughts on it for a future article. Make sure you’re comfortable with Moneyhub’s security promises before you give away your personal information though.

How much to save?

The simple answer is that you should save as much as you can, after spending on things that are essential. Of course, what is essential is subjective. For example, I see a car or television as luxury items that I don’t need. However, a Mac or an iPhone are productivity boosting investments to me.

Let us crunch some numbers to get a rough idea of how much a graduate should target to save. The typical salary for a young professional shortly after graduating is about £30,000 before tax (graduatejobs). Using MoneySavingExpert’s income tax calculator, this means that a graduate can take home approximately £2000 a month.

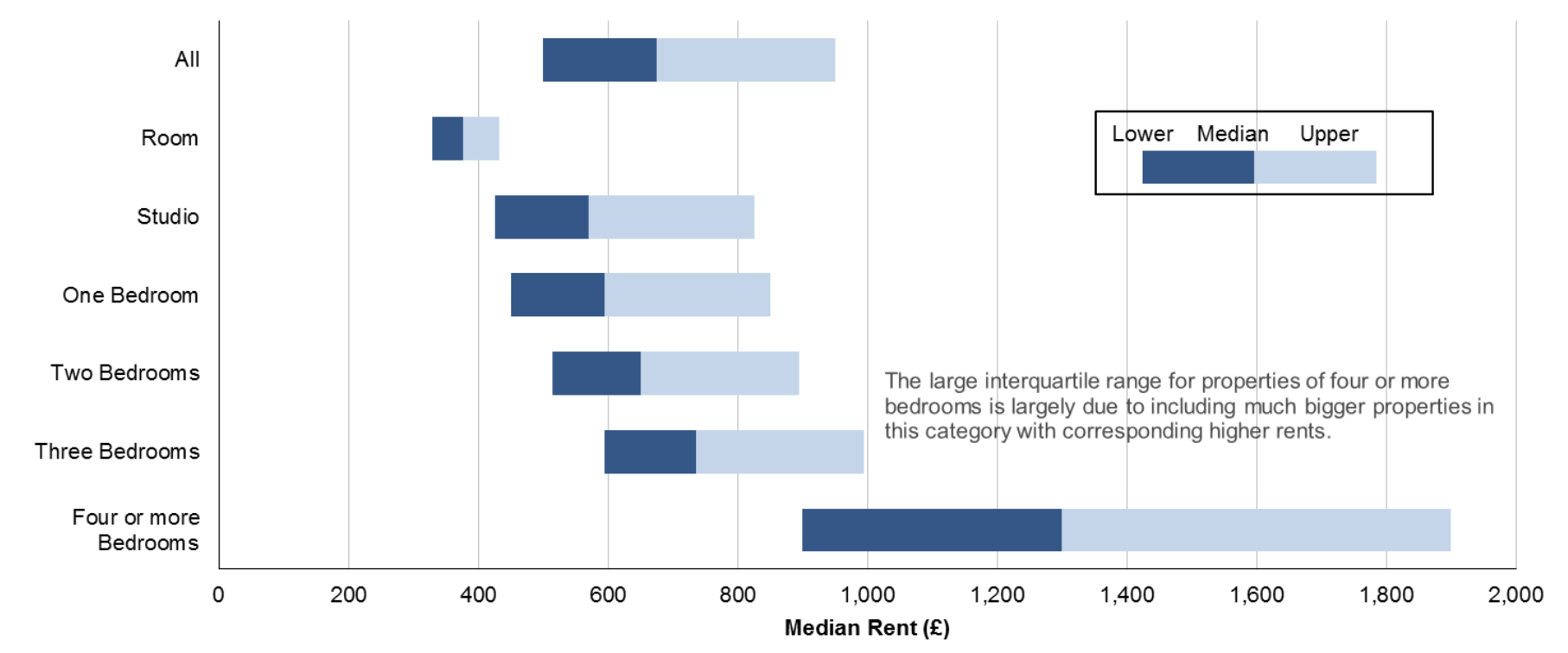

The biggest expense for most people on their first job is rent unless they are lucky enough to live with their parents or rich enough to own a house already. The image below shows the monthly rents by bedroom category (Valuation Office Agency). The cheapest option is renting a room in a shared house. Let’s assume that this works out to about £400 a month including all bills and council tax.

Food is the next most significant expense. Let’s say food costs about £200 a month. Let’s also set aside £2000 a year to spend on holidays. This works out to approximately £150 a month. We also have to account for eating out, socialising, entertainment, general merchandise, healthcare etc. Let’s say all of that adds up to about £250 a month.

As I mentioned earlier, a car is a luxury item from my point of view. By locating to somewhere close to work and cycling/walking to work, you can eliminate transport costs.

This leaves you with 2000 - (400 + 200 + 150 + 250) = 1000 pounds a month in savings. Yes, that’s right. It’s half your income. You can and should try to save at least 50% of your income in your first job. Your target may be bigger or smaller depending on your circumstances and your priorities. The important thing is to have a target, and to make sure that your target is achievable!

Conclusion

There are many good reasons to save money. It is not hard, but it does require some effort. However, if you learn to enjoy the process of money management, it can be quite fun. Before you can improve your financial situation, you need to establish ways of tracking your financial status and define your goals. With a little bit of discipline, the average UK graduate should be able to save at least half their monthly income after taxes. Money management does not mean that you cannot indulge yourself with your hard earned money, it just means that all your expenditures are planned for. If this post resonates strongly with you, or if you have any feedback on anything I said, please do leave me a comment.